Selectmen's Meeting: New Tax Rate - Relief Options for Seniors

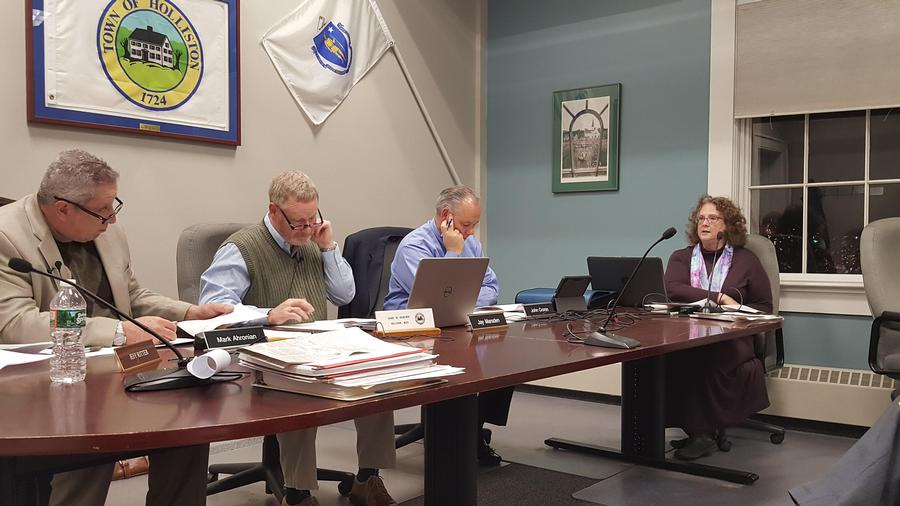

Selectmen met with the Assessors to review the assessed values and tax rate based on 2017 sales.

The Fiscal Year 2019 tax rate increases by 18 cents per thousand dollars of assessed value, i.e. from $18.67 to $18.85 (a 1% increase.)

That’s about $130 per year on the tax bill of an average single family residence (estimated assessed value of $449,000 and tax bill of $8,513.)

The assessed values of individual properties increased by an average of $2,000. The total town value rose by 2% to $2,541,853,327. These numbers are based on 187 arms-length property sales in 2017.

The town reaped increased revenues of $962,000 from new construction. The town budget increased by 3%. The total amount that must be raised by taxes, called the levy, is $47,917,935.

Single Tax Rate

The Assessors recommended maintaining a single rate for residential and commercial/industrial and personal properties. The town has about 12.5% non-residential properties, which is generally considered too low to split the rate, because it would potentially hurt the small, but important, local business economy.

To read the complete presentation from the Assessors, https://www.townofholliston.us/sites/hollistonma/files/file/file/fy2018_classification_hearingkp-1.pdf

Tax Relief for Seniors

Selectman Mark Ahronian voiced concern that seniors find it very difficult to pay for the taxes in town. "Twenty-three percent of residents are seniors and it behooves us to look at what we can do for them," he said. Assessor Kathy Peirce reminded everyone that Holliston has several abatement programs for seniors as well as exemptions and hardships for veterans and the blind. "I think we need to do a better job of marketing these programs."

To get information on the programs visit the town website. https://www.townofholliston.us/sites/hollistonma/files/file/file/tax_exemptions.pdf

Thank you for identifying the people in the front page photo. Seems to me this is rarely done in HR even though it's standard practice in journalism. Information is more meaningful when you can put a face to the name, especially when a named person is quoted in the article. Thanks also for the links to specific areas of the town's website. Please continue this in your reporting. Most of my searches on the site have ended in failure. Maybe I keep crashing into dead ends because my brain works differently than others' do. Thanks to these links I have a clear path to enlightment. Kathy Kelly

Kathy Kelly | 2018-11-28 10:36:19

I so agree with you, Bob. The Assessors have discussed producing materials that are simple to understand. As for the value of the abatement, this is a decision at Town Meeting. If you have thoughts to share with the Assessors, the Board meets on Thursday mornings at 8:00 a.m. at Town Hall. The Board can explore options within the state law and recommend changes to Town Meeting.

Mary Greendale | 2018-11-28 08:11:00

It would help to have clear and publicized information on what constitutes "income" and "assets" under the exemption for seniors rules, and who would qualify, specifically, for "widow, widower, person over 70..." category. Can a handout or summary be prepared? Also, an exemption of $210 for "persons over 70, etc." for a Holliston total tax bill isn't much of an exemption.

Kevin Robert Malone | 2018-11-28 06:58:41