Homeownership: Key to Building Personal Wealth

Homeownership: Key to Building Personal Wealth

Is homeownership still all it’s cracked up to be? The resounding answer? Yes!

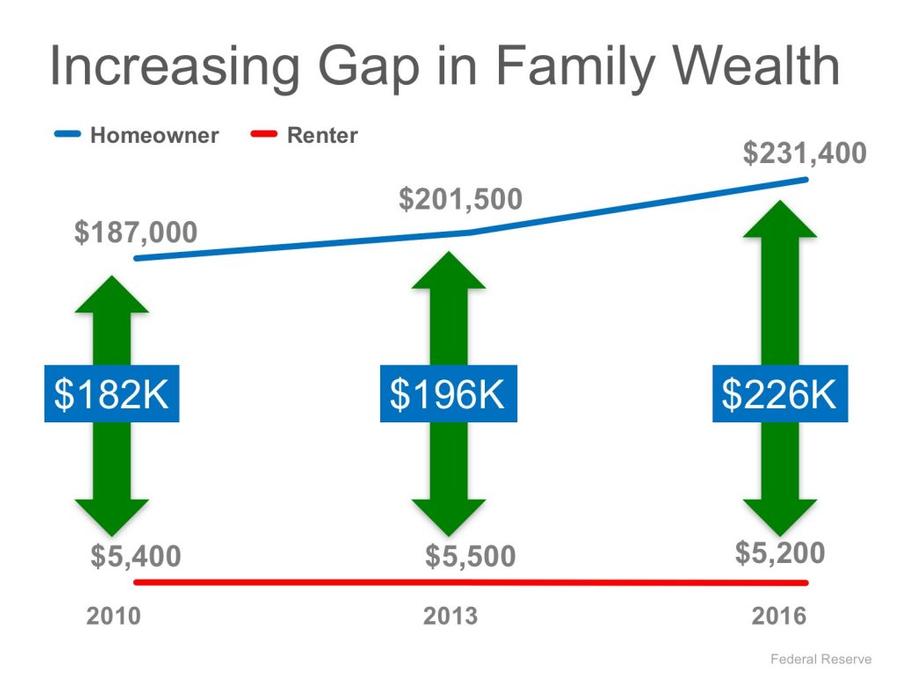

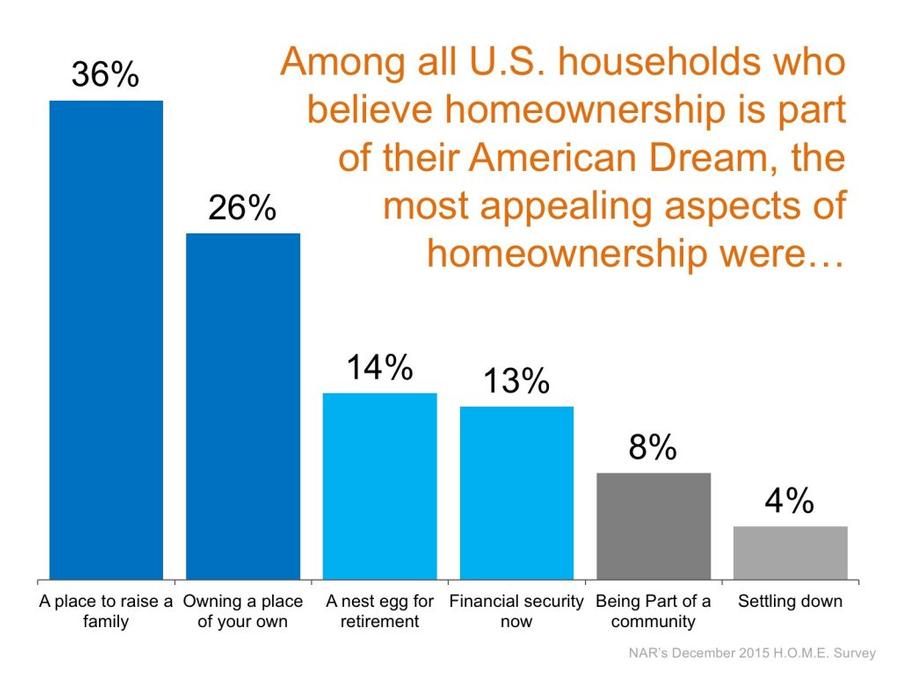

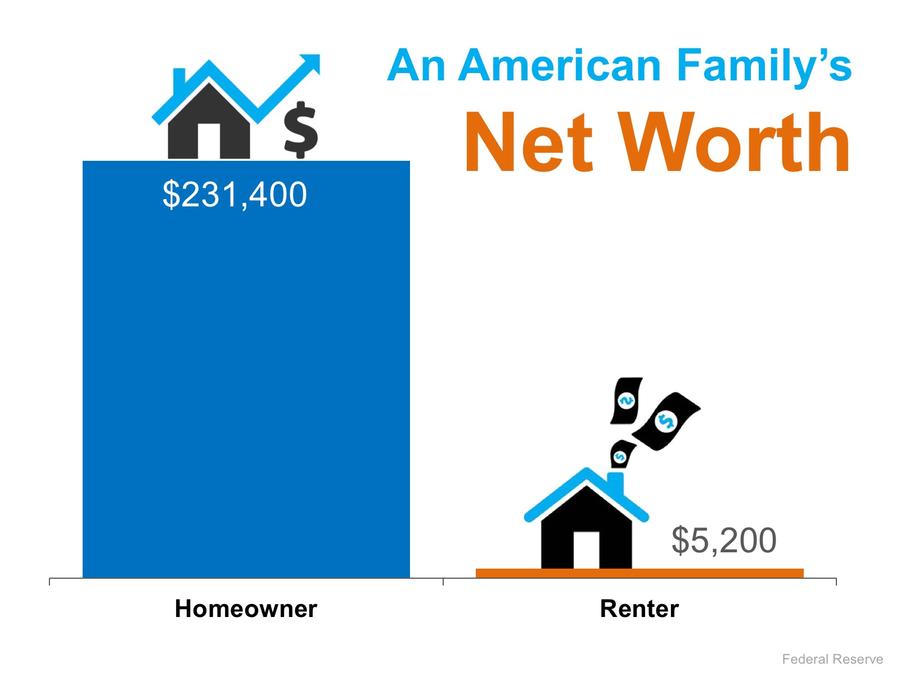

Regardless of the fiscal, economic or political environment, owning a home is a key element of building personal wealth. Prior generations aspired to home ownership as a symbol of stability, accomplishment and whether intentional or not, a form of savings. History has proved that those who have purchased a home gained wealth at a rate that far outpaced those who rented.

Five key reasons why homeownership builds wealth:

- Homeownership is a form of forced savings – Paying your mortgage each month allows you to build equity in your home that you can tap into later in life for renovations, to pay off high-interest credit card debt, or even send a child to college. As a renter, you guarantee that your landlord is the person with that equity.

2. Homeownership provides tax savings – One way to save on taxes is to own your own home. You may be able to deduct your mortgage interest, property taxes, and profits from selling your home, but make sure to always check with your accountant first to find out which tax advantages apply to you in your area.

2. Homeownership provides tax savings – One way to save on taxes is to own your own home. You may be able to deduct your mortgage interest, property taxes, and profits from selling your home, but make sure to always check with your accountant first to find out which tax advantages apply to you in your area.

3. Homeownership allows you to lock in your monthly housing cost – When you purchase your home with a fixed-rate mortgage, you lock in your monthly housing cost for the next 5, 15, or 30 years. Interest rates have remained around 4% all year, marking some of the lowest rates in history. The value of your home will continue to rise with inflation, but your monthly costs will not.

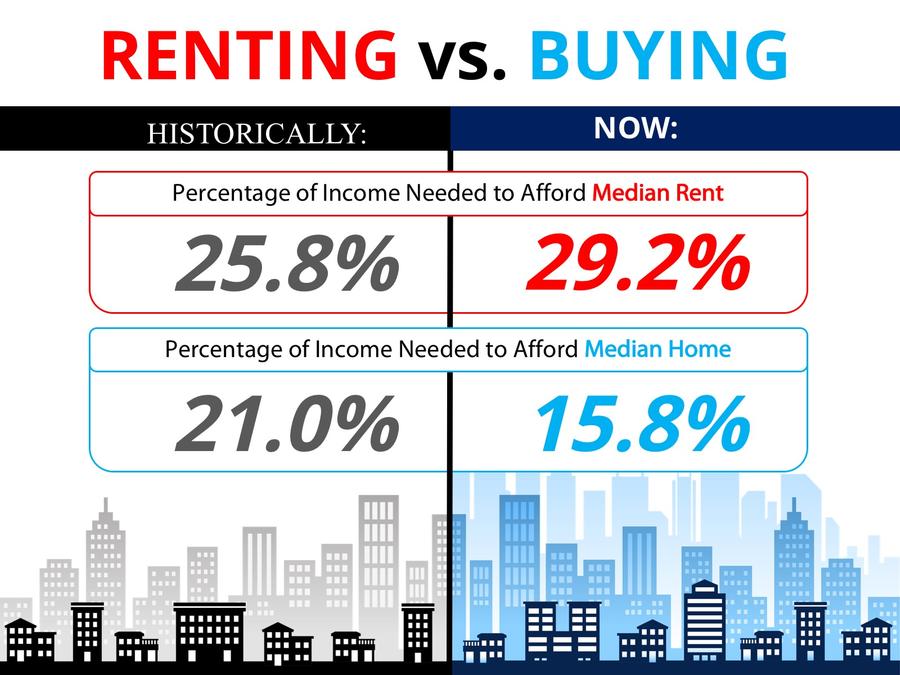

4. Buying a home is cheaper than renting – According to the latest report from Trulia, it is now 37.4% less expensive to buy a home of your own than to rent in the US. That number varies throughout the country but ranges from 6% cheaper in San Jose, CA to 57% cheaper in Detroit, MI.

4. Buying a home is cheaper than renting – According to the latest report from Trulia, it is now 37.4% less expensive to buy a home of your own than to rent in the US. That number varies throughout the country but ranges from 6% cheaper in San Jose, CA to 57% cheaper in Detroit, MI.

5. No other investment lets you live inside of it – You can choose to invest your money in gold or the stock market, but you will still need somewhere to live. In a home that you own, you can wake up every morning knowing that your investment is gaining value while providing you a safe place to live.