An Argument for Progressive Tax Reform

Holliston just faced significant budget cuts to our schools, narrowly avoiding a call for a tax override. The budget hammered out with great effort is a temporary fix, and you can be sure that next year will require another conversation about the budget. This is not a sustainable way to keep our schools strong and our property values high. Holliston is also facing a need for large investments in our water infrastructure, from water filtration to remove minerals from one well, to replacing miles of aging water mains. The state will provide no funding at all for this multi-million dollar project.

The MBTA system ground to a halt during the historic winter storms. Chronic underfunding, and the debt burden from the Big Dig, means a system that is aging, patched together, and vulnerable (rather like our bridges, roads, and dams). Many state agencies are faltering, like the Department of Children and Families, which has been understaffed for years. After 2009, the DCF saw an overall budget reduction from $836.5 million to $779 million in 2014, with significant decreases in managers and social workers. Between 2001 and 2015, Massachusetts cut funding for higher education by 21%, environmental protection and recreation by 33%, local aid by 45%, and so on. Keep those numbers in mind when you look at current budget proposals.

People debate whether we should increase property taxes and water fees locally, and legislators talk about increasing the sales tax and the gas tax or other fees. But is this the right way to increase revenue? These taxes and fees are regressive, hurting those with lowest incomes the most.

We live in a wealthy state (ranked #6 by income) in one of the wealthiest nation on earth (#7). Why can’t we properly fund our educational system, infrastructure, and transportation needs? We ordinary citizens pay our taxes, and we pay plenty. Some decry wasteful government spending, unions, or blame the poor, but in doing so miss the larger context that includes years of harsh budget cuts. No human system or government agency is going to be perfect, for sure, but the real problem is shrinking revenues, and the answer is fair, progressive tax reform.

We are becoming an increasingly unequal society. More and more money is being concentrated in fewer and fewer hands, hands that use their wealth to buy ever more political power, including the power to set tax policy. It’s a vicious cycle. Between 2013 and 2015, the 14th wealthiest people in America increased their net worth by $157 billion, which is more wealth than is owned by the entire bottom 42% of this country (more than 130 million people). This is unjust, unsustainable, and a threat to democracy. The upcoming presidential election is set to be the most expensive again in history, and much of the money will come from a very few exceedingly deep pockets who will be expecting a return on their investment, and one such return will be highly favorable tax polices for themselves and their corporations.

Wealth inequality means that gains from the increasing productivity of workers are redistributed to those on the top, who can stuff profits in offshore tax havens. One main pipeline for wealth redistribution lies in our tax codes, where loopholes allow regressive taxation. For example, Congress is set to vote on a repeal of the estate tax, which means that vast inheritances might pass intact to heirs, solidifying a new aristocracy of sorts. This repeal would cost $270 billion in revenues over 10 years, and only effects households worth $5.4 million or more. Do they need a tax break of this magnitude?

According to the Massachusetts Tax Fairness Commission we have a regressive, not progressive tax system. Massachusetts is one of only seven states that levies a flat (not graduated) income tax rate. Other taxes like the sales tax, the gas tax, fees, and property taxes make the state tax system regressive overall. The means the richer you are, the smaller share of your income goes toward state revenue. According to the Massachusetts Budget and Policy Center, those who make $21,000 per year or less pay 9.5% of their income toward state and local taxes, while those in the top 1% (who earn $700,000 or more) pay only 6%. During the last decade or so, Massachusetts has actually benefited the wealthiest by reducing the income tax rate and the tax rate on investments.

Note that a flat tax rate is also regressive, because the share that lower income families pay comes from money they need for daily life, and that loss hurts them proportionally more. Our flat state income tax rate is regressive, except that we offset the flat rate somewhat by providing exemptions for very low-income filers, a low-income credit, a large personal exemption, and EITC. A graduated state income tax could do more to soften wealth inequality, provide tax fairness, and help fund vital needs like schools, transportation, and infrastructure to provide for the commonwealth.

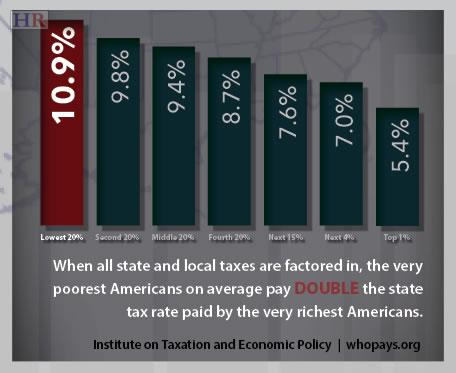

Our state income tax rate decreased from 6.3% in 1998 to 5.15% currently, and over that time (roughly) we have suffered a 45% reduction in local aid. The last automatic decrease from 5.2% to 5.15% saves an average of only $19 per taxpayer, but costs the state $70 million in revenue for 2015, and that loss will double in 2016. If we reduce the income tax to 5.0% as planned, we will lose $830 million a year. Beyond the obvious problems that will occur from reducing revenue this much, there’s an overriding issue of fairness: wealthy families benefit far more than lower income families in income tax reductions. The top 1% of income earners will receive almost $1,000 in income tax reductions going from just 5.2% to 5.15%. Massachusetts is not alone in having a regressive system. Such regressive state tax systems are actually why our nation has an overall regressive tax system; nationally, the poorest pay on average double the state tax burden than the wealthiest pay.

On the Federal level, corporate tax loopholes and many tax advantages for the wealthy also that mean the very rich pay the least share of their incomes while leaving the rest of us struggling to cover the lost revenue and/or face severe cuts. For example, Prudential Financial made $3.5 billion in US profits, and received a $106 million dollar rebate from the IRS. One in four US corporations pay no federal taxes at all, despite high profits, and the effective corporate tax rate has fallen to a 40-year low of only 9.9% (2012). If the top 1% paid what the average taxpayer pays in income tax, and if corporations lost their corporate welfare, we would see $2 trillion or more in revenue.

Massachusetts also offers corporate tax breaks that reduce our revenues. For example, we could close the loophole that allows companies to hide profits to offshore tax havens, and instead tax that income as domestic profits. Closing just that one loophole could increase state revenue by $79 million.

We often hear that tax subsidies are necessary to attract jobs and encourage investments, yet so many times we have given companies tax breaks, only to have them take the subsidy, lay off workers, and leave. We actually spend twice as much on corporate welfare as we do on social welfare, and you can thank lobbying for that, which offers a tremendous return on investment for corporations.

Our financial problems are not accidental, nor are they conditions that we must simply accept on a local level. Our problems result from public policy that benefit a few extremely well, and reflects the growing control that wealthy special interests exert over public policy.

Awareness of regressive vs. progressive taxation may not help Holliston with our budget woes in the short term. We will need much stronger advocacy and activism from our citizens, town leaders, and state legislators to reform the Massachusetts tax system to make it less regressive and fund our needs, and also increasing advocacy from our Congressional representatives to reform the Federal tax code to end egregious tax dodging.

We will also have to ramp up objections to such extreme spending on political campaigns, curtail lobbying, and end the revolving door that allow wealthy interests to set public policy for private profit. In a word, we have to fight corruption to reform an unjust tax system that costs us dearly.

Dianna, Excellent analysis of the underlying funding issue that plagues our local and state governments. I agree with your assessment of the need for a progressive state tax system here in the Commonwealth. Thanks for taking time to present such a lucid argument. Bill Dooling

Bill Dooling | 2015-04-22 06:51:04

Very well argued piece, Dianna. Keep up the good work.

Leslie Dooley | 2015-04-19 17:29:38

But wait there is more. With this state and federal tax savings local costs increase. Programs that should be funded across the masses, like SPED, are increasingly becoming funded locally. In addition to this "Savings" the Federal and State expectations of how much the towns are to spend on education increases as well. But wait don't forget there is a buy one get one free deal... For every deal we cut a tax we increase a fee. So what might be tax deductible is no longer tax deductible. If our money to fix the pipes in Holliston go under the Water Department that is not tax deductible. However if it was added to the tax rate in Holliston we could. Lowering our taxable income lowers revenue which lowers local aid. Before we know it we are in a tax tornado. Oh wait we are already there. Be very careful who we assume is going to save us. Some people in office are protecting their own interest and not the country wide interest and they don't need to have a party associated to them. The problem with some of what is reported is some wealthy income is taxed at the same rate as we are all taxed on as the revenue is from investments. Also recently my wife went back full time to help pay bills. However we now bring home less even though we make more. Because we lost education deductions and others. I'm not sure that is fair. Maybe she needs to go back to part time? Well written... I'd love a subsequent article on how we fix the problem.

But wait there is more | 2015-04-19 11:33:12

Thank you for taking the time to write this article. Very well written and very informative.

Douglas Schmidt | 2015-04-19 06:42:51

Excellent article Dianna.

Warren Chamberlain | 2015-04-19 04:50:06