Weathering The Storms

From 1990-2009, the S&P 500 returned an average of 8.2% annually, yet the typical investor averaged a 3% yearly return. Why? Investors chased performance. They got emotional, responded to headlines, and ignored the fundamentals of diversification, discipline and patience. They bought at market peaks and bailed out at market lows, and then they waited for that rare “perfect moment” to get back into equities.

Instead of fleeing the market when stocks hit headwinds, the seasoned investor takes a moment to adjust the sails (if even necessary) while still investing consistently with quality and long-term value as the key criterion. This approach helps one ride through market fluctuations and give them a chance to outperform the emotionally-driven investor in the long term.

Do you have concerns about your investment decisions right now?

We’re happy to help you address them. Let’s talk about where you are right now with your portfolio and the level of progress you are making toward your financial goals. The more you understand about the long-term behavior and potential of the market, the more you realize the need (and value) of patience and perseverance. We know that mitigating risk is just part of the job, mitigating behavior and poor decisions is just as important.

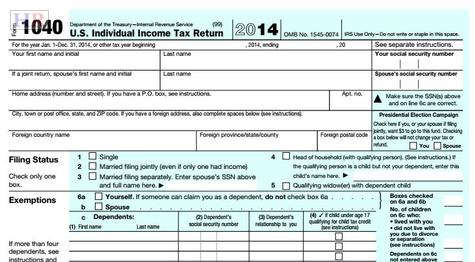

Getting a Jump on Taxes - Filing has Begun!

IRS filing season officially began Tuesday for 2015, and there is wisdom in filing your 1040 well before April 15. You can get it out of the way, and if you e-file, you can put yourself in position to receive a refund earlier.

What should you gather up for your tax professional?

If you want to save time and possibly money along with it, come to your preparer’s office ready with the appropriate paperwork. If you own a business, that list includes all W-2s and 1099-MISC forms you get from clients, any 1099-INT and K-1 forms displaying interest income, your Schedule C and P&L reports, and any and all paperwork you can round up detailing your expenses – your personal expenses too, not only business costs but also any tuition, medical and miscellaneous ones. If you have made charitable contributions worth itemizing, that paperwork needs to reach your preparer. The same goes for documents detailing mortgage interest, other forms of interest paid, and any tax already paid.

Market Brief

Crashing oil prices. Falling Euros. Rising Swiss Francs. European quantitative easing. Russia’s credit rating downgraded to junk. A rapidly expanding U.S. economy. Greece challenging austerity. It has been an eventful few weeks to say the least.

The clearest impact of all this on the markets has been a move to the safety of U.S. bonds, bringing another decrease in 10 year U.S. treasury yields of more 20% in the last three months to 1.83%. Investors looking for shelter from the economic storm seem to have found it in U.S. dollars backed by the growing U.S. economy. We continue to think that the interest rate on intermediate and long-term U.S. treasuries is too low for the risk they pose in a rising rate environment, and prefer to take on credit risk rather than interest rate risk in order to increase yields in our bond investments.

U.S. stocks are up about 4% over the same period, though they have experienced some significant short term volatility while staying within a 7% range, currently sitting in the middle of it. International developed markets and emerging markets are each up about 1% over the past 3 months, with emerging market stocks 9% above their lows during the period and developed market stocks 4% above theirs. We expect continued volatility and see this as a buying & rebalancing opportunity.

Given current interest rates, it’s a great time to refinance or lock a new mortgage rate. And while we usually avoid giving travel advice, with the significant increase in the Dollar vs the Euro we’ll definitely be watching out for great deals on European vacations (just not to Switzerland!) in the near future.

***********************************************************************************************************************

Copyright © 2015 Balanced Rock Investment Advisors, All rights reserved.

You're receiving this email because you opted in at our website or signed up at an event.

Our mailing address is:

Balanced Rock Investment Advisors

252 Roslindale Ave

Roslindale, MA 02131